PRESS RELEASE

Oil major does not raise dividend for 3 quarters in a row and keeps it at $0.344, 73% of pre-pandemic level of $0.47 per share

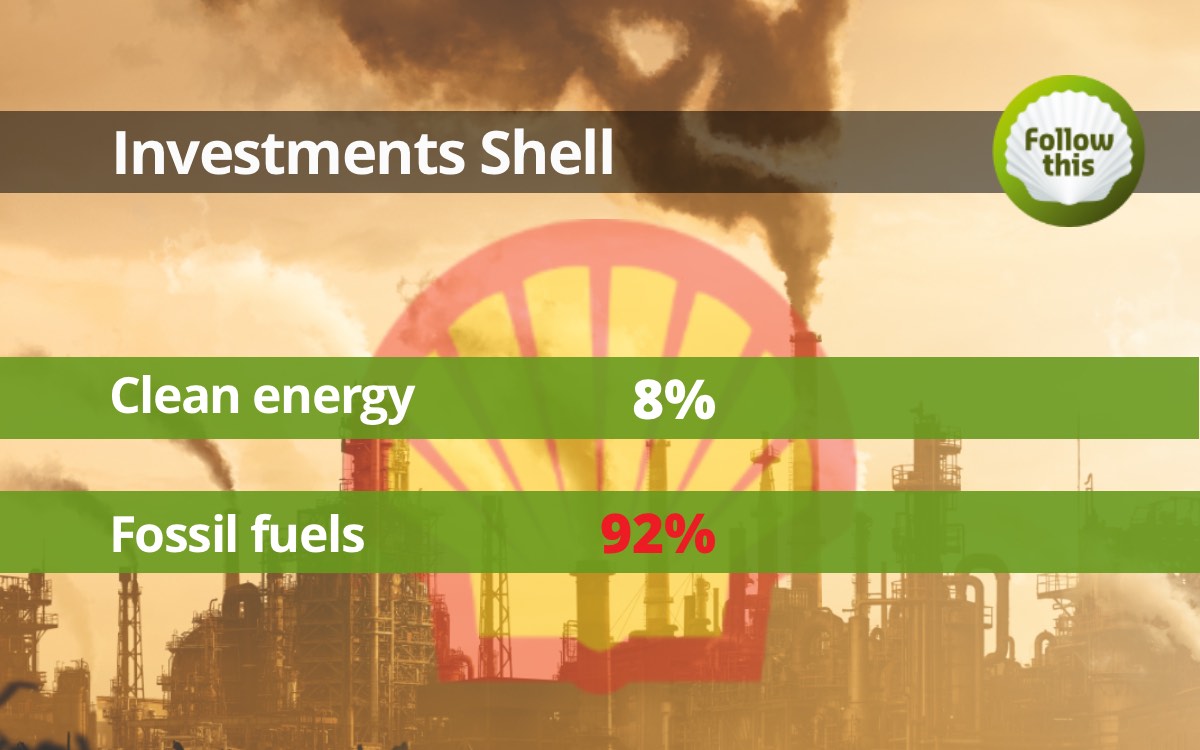

Shell’s investments in the division Renewables & Energy Solutions (RES) are down to 8% ($409 million) of the oil major’s overall capital expenditure ($ 4,950 million), the oil major’s third quarter results reveal (from 9% in Q2). The backtrack in investments in clean energy comes after Shell scrapped emissions reduction targets in March. At least 92%* of investments remain tied to fossil fuels.

* RES includes pipeline gas

“By continuing to bet on fossil fuel expansion, the board of Shell jeopardizes the future of the company,” says Mark van Baal, founder of activist shareholder group Follow This. The IEA forecasts a decline in oil and gas demand after 2029.

“Fossil fuel growth delays the transition and increases the risk of a carbon lock-in, which will make it harder to pivot to renewables each year.”

“Moreover, Shell’s investments in fossil fuels are in collision course with the Paris Climate Agreement that requires almost halving emissions by 2030.”

Investors hold the key

“Investors who are committed to Paris must change the mind of the board of Shell, one of the highest emitters. Big Oil can make or break the Paris Accord. Shell could lead and thrive in the energy transition.”

Captivated by high oil price

“Shell is increasing reliance on fossil fuels because the board is captivated by current profits from high oil and gas prices,” says Van Baal.

“However, the handsome carbon-based business model will be over as soon as fossil fuel companies must pay for climate damage. Instead, Shell should use the current profits to explore new business models instead of more oil and gas.”

“Shell’s attitude shows a lack of imagination beyond oil and gas, and failure to understand the concepts of disruptive innovation and stranded assets,” says Van Baal. According to Carbon Tracker, two thirds of fossil fuel reserves must remain in the ground to tackle the climate crisis.

Dividend

The oil major announced to keep its dividend at $0.344. In 2020, during the pandemic Shell cut two thirds of its dividend. The dividend is now at 73% of pre-pandemic level of $0.47 per share. The last time Shell increased dividend was on February 1, 2024. This is the first time Shell does not raise dividend for 3 quarters in a row since the historic cut in dividend.

Share buybacks

Shell also announced to continue its share buyback program. “Share buybacks reveal a lack of imagination beyond oil and gas. A company that buys back shares is effectively saying to investors: ‘We know of no better use for this money than to return it to you’.”

Baby steps

“Seven years after Shell bowed to shareholder pressure by announcing to embark on the energy transition, CEO Wael Sawan undoes the baby steps his predecessor Ben van Beurden took.”