Please find herewith six recent developments regarding climate resolutions at Big Oil’s forthcoming AGMs:

- Yesterday, Valero reported that the proposal failed to pass. The outcome came to our dismay, especially after large proxy voting advisors ISS and Glass Lewis advised to vote FOR.

- TotalEnergies tries to keep the investor-led climate resolution off the ballot by claiming the request for emission reduction targets in line with the Paris Accord “contravenes French legal rules”. The co-filers are considering what possible next steps they can take.

- Nine out of the ten largest investors in the Netherlands predeclared their votes FOR climate resolutions and “call on our fellow investors to […] vote in favour of shareholder resolutions that encourage progress towards the Paris Agreement 1.5°C warming scenario” (Blue Sky Group joined later). ABP announced to “in principle, vote in favour of shareholders’ climate resolutions” (ABP tightens climate voting policy, in Dutch).

- ISS advises shareholders to vote FOR the climate resolutions at Valero, Occidental, ConocoPhillips, Phillips 66, and Equinor, and – inconsistently – AGAINST at BP. Glass Lewis advises to vote AGAINST all these climate resolutions, except in the case of Valero (FOR). In 2021, the percentage of investors that didn’t follow Glass Lewis and ISS advise to vote AGAINST doubled to 30% (up from 14%) at Shell.

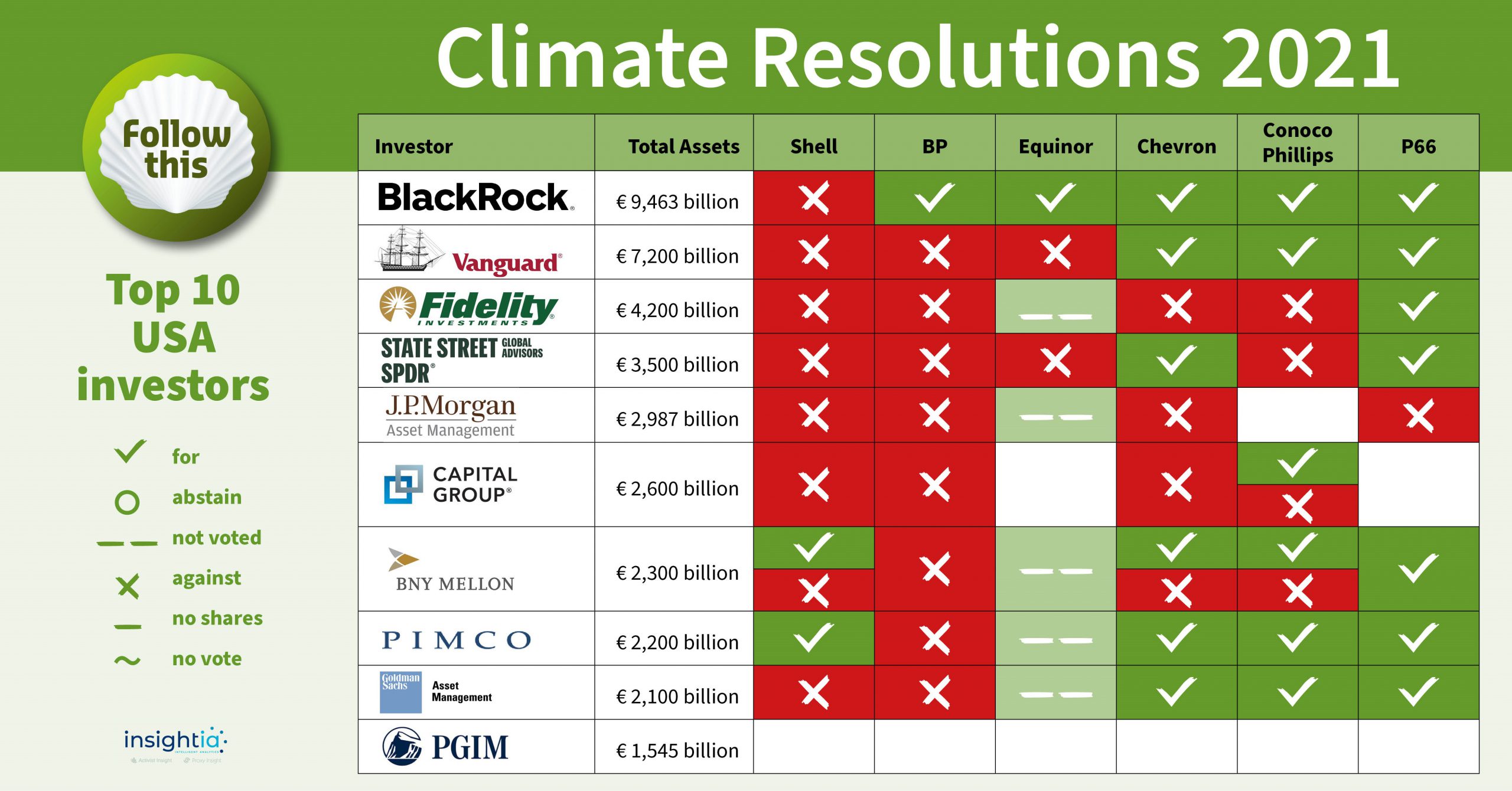

- Analysis of voting behaviour shows two kind of voting rationales: Group A insists on science-based target and votes FOR all climate resolutions at Big Oil; group B settles for company-issued targets and votes AGAINST at companies with climate disclosures. Group A is growing – for example, to 30% at Shell in 2021.

- Climate change presents liability risks for directors and institutional investors of Oil and Gas Majors. Shell’s directors “risk future personal liability” for not aligning with the Paris Accord, writes Paulussen Advocaten, the law firm that won the Shell case in letters to Shell’s directors and investors. In an additional letter to investors, they write: “Current and foreseeable legal developments with regard to climate change liability risks for directors and institutional investors of Oil and Gas Majors are additional reasons for seizing this opportunity [to vote FOR climate resolutions].” Please find attached the letter to investors in oil and gas companies.

Please find attached a detailed investor briefing about 10 climate resolutions filed for 2022. This package includes an overview of each companies’ climate targets, resolutions, exempt solicitations and voting advice.

You can watch a summary or the entire Follow This investor symposium here.

Finally, at the risk of stating the obvious:

- Not a single oil major is Paris-aligned according to the CA100+ Net Zero Company Benchmark.

- Oil majors have proven that they will not fully align with the Paris Accord on their own accord. Moreover, some oil majors misuse engagement as an excuse to continue their current strategies that are not Paris-consistent. For example, BP claims to have “heard clear support for [BP’s] strategy” during “extensive engagement with investors after the vote”.

Only engagement combined with voting will send a clear and unambiguous signal to the boards of these companies.

Please share this briefing with relevant colleagues in your network.

We thank you in advance for your votes.