2021 was a watershed year for climate votes at Big Oil; investors must escalate pressure in 2022 to reach the Paris Accord

What a year. In May, an unprecedented number of shareholders voted in favour of the Follow This Climate Resolutions: in Europe, votes more than doubled for the third time; in the US, votes reached historical majorities.

These major milestones would not have been possible without the growing number of investors that refuse to settle for company-issued disclosures, but insist on science-based emission reduction targets by voting for climate targets resolutions. As we reflect on this momentous year, we want to thank those investors for their bravery and commitment.

In the same period, the IEA net zero roadmap, the historic court ruling for Shell, IPCC’s Sixth Assessment Report, divestments by prominent investors, and COP26 in Glasgow reiterated the necessity for a reduction of absolute emissions of 45% by 2030 (compared to 2010) to achieve the Goal of the Paris Accord. From the courtroom, to the lab and on the balance sheet, the consensus is clear: oil majors need Paris-aligned decarbonisation strategies that reduce emissions in the short-term.

However, half a year after the shareholder rebellions during their AGMs, the boards of oil majors are still determined to increase absolute emissions, while claiming to have support from their shareholders for their own ‘Paris-consistent’ strategies.

In responses to the votes, required by the UK corporate governance code, BP has “heard clear support for [BP’s] strategy” during “extensive engagement with investors after the vote”; Shell claims “broad indications of support for Shell’s strategy”. For the record: Shell and BP’s current strategies both increase absolute emissions by 2030; BP expects “the absolute level of emissions to grow between now and 2030, even as the carbon intensity falls” (Reimagine Energy, slides & script) and in-depth research by Global Climate Insights shows Shell’s absolute emissions will rise as well.

We are sure this is not what most of you want.

From BP and Shell’s official responses, we can only draw the following conclusion: these companies abuse engagement with investors, and only voting sends a clear and unambiguous signal to the boards of these companies.

In previous years, Big Oil’s executives have shown that they only move after their shareholders vote for climate resolutions. So far, five oil majors have reluctantly set targets to reduce product emissions (Scope 3) after shareholders’ votes, yet all fall short of Paris-consistency. Big Oil needs a clear shareholder mandate to set science-based targets and articulate a Paris-consistent decarbonisation strategy.

In 2022, voting must compel oil majors to set Paris-consistent Scope 3 targets; targets that lead to deep cuts in absolute emissions reductions by 2030.

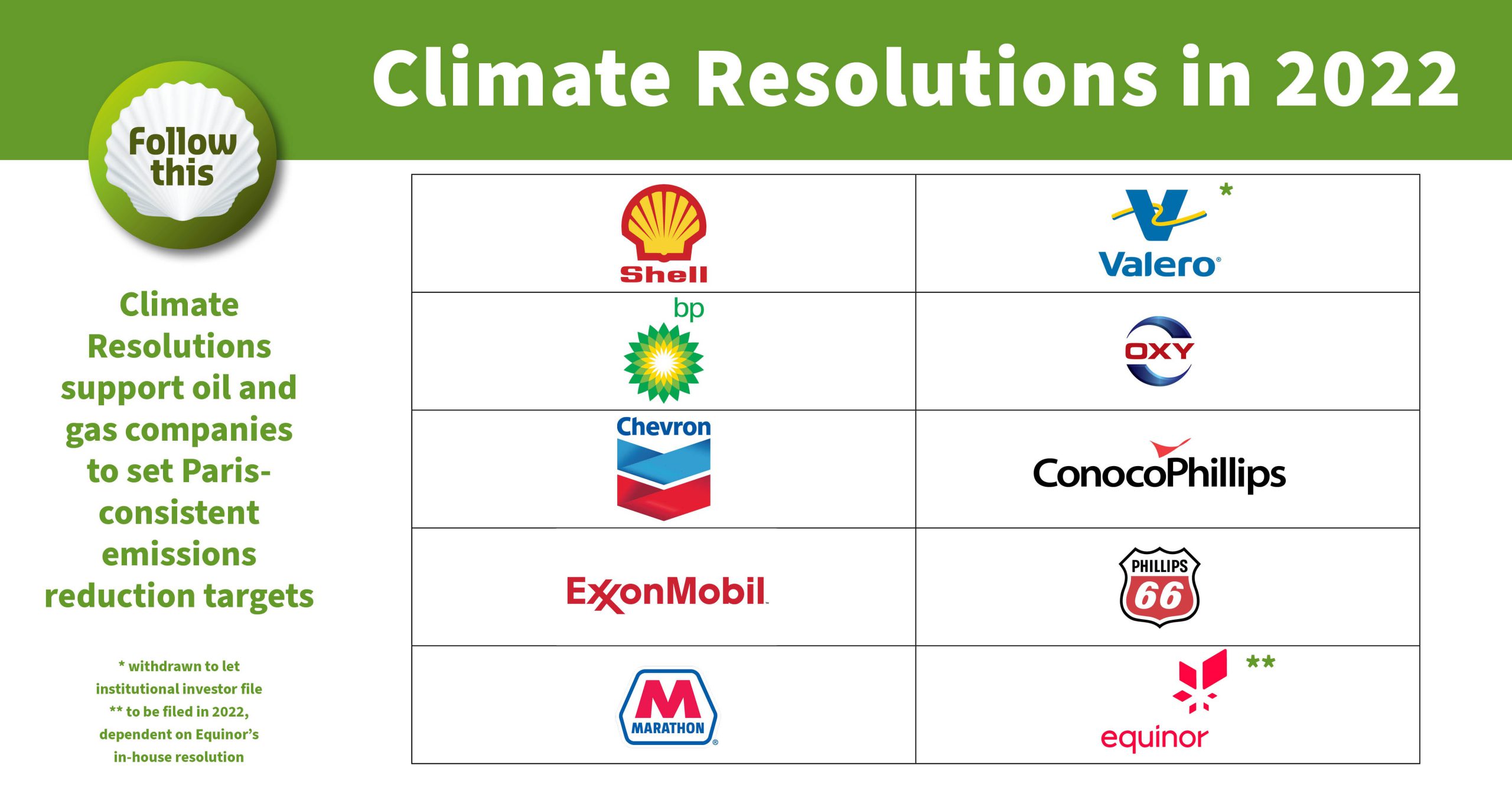

Big Oil faces at least 10 climate resolutions in 2022

Follow This filed again at Shell, BP, Chevron, ConocoPhillips, Phillips 66, and Occidental Petroleum*, and for the first time at ExxonMobil and Marathon Petroleum #. We expect that Engine No. 1’s new board members and our climate resolution will reinforce each other at ExxonMobil in a united front for the climate. We filed our resolution at Valero but subsequently withdrew after collaborating with an institutional investor, who has filed a similar climate resolution in our place. We postponed the filing of a climate resolution at Equinor to wait for their in-house resolution; in case Equinor’s in-house resolution will also request shareholder support for Paris-consistent emissions reduction targets, our resolutions will not be needed. You can find the text of the resolutions here.

The IPCC could not be more clear”: ‘unless there are immediate, rapid and large-scale reductions in greenhouse gas emissions, limiting warming to close to 1.5°C or even 2°C will be beyond reach’ (IPCC Sixth Assessment Report Press Release, 9 August 2021).

We wish you happy holidays and a breakthrough in the fight against climate change in 2022,

Follow This

* We filed at Occidental Petroleum in 2021 but withdrew following engagement with the company

# In the US, oil majors normally try to exclude climate resolutions from their AGMs with no-action letters at the SEC. In 2021, thanks to the Biden administration, the Follow This resolutions passed the SEC for the first time.