INVESTOR & MEDIA BRIEFING

Northern approach contrasts with that of European peers

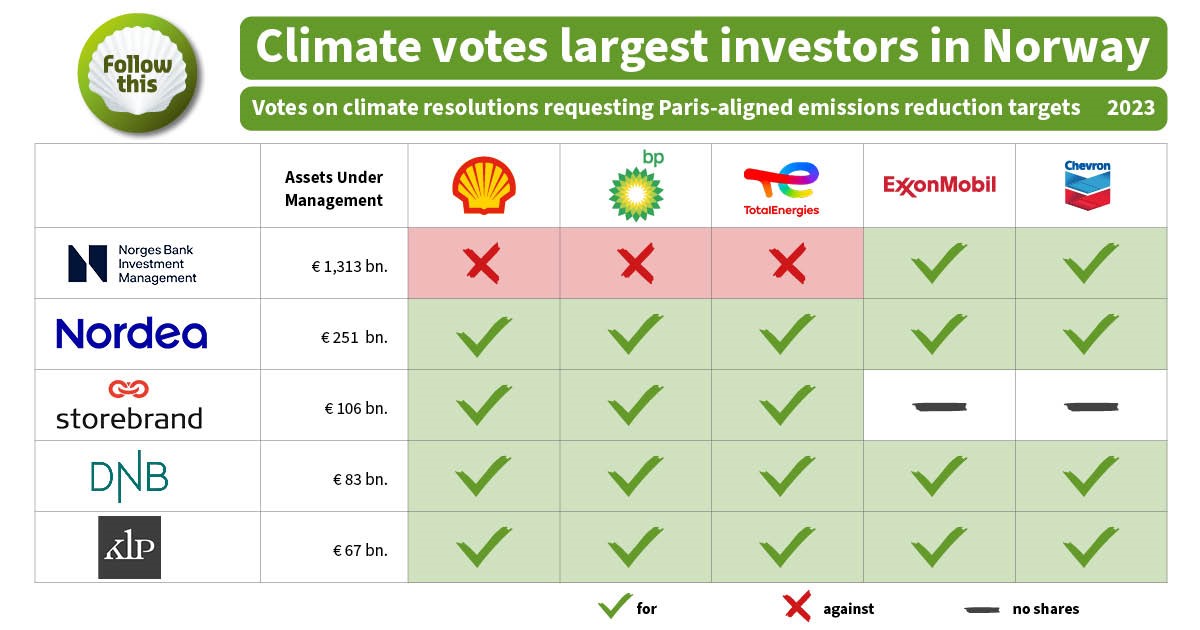

Norway’s five largest investors supported nearly all climate resolutions at Big Oil in 2023, a new voting report by Follow This shows. This voting behaviour contrasts with that of many peers in Europe, who believe in either engagement or divestment.

“These Norwegian investors show the world that voting is essential to active ownership,” says Mark van Baal, founder of Follow This. “Big Oil will only change if shareholders vote for change. Investors who divest, transfer their shares to less responsible shareholders, enabling Big Oil to drill for more oil and gas with disastrous consequences for climate and economy.”

In the United Kingdom, most large investors voted against climate resolutions in 2023, favouring an approach based on engagement. In the Netherlands, many large investors have divested from Big Oil.

Next month, the Follow This climate resolution will come to vote again at the shareholders’ meeting of Shell again. Meanwhile, Exxon is suing Follow This to stop climate resolutions from being put to a vote, demonstrating the impact of climate votes.

Voting part of active ownership

Norwegian funds consider voting as an essential part of active ownership of fossil fuel companies. Their approach does not stop at engagement behind closed doors.

Norges Bank Investment Management (NBIM) in their Responsible Investment report 2023, page 7: “Our goal is to reduce risks and promote long-term value creation at the companies we invest in through active ownership. We do this through dialogue with companies and voting at their shareholder meetings.” (link here)

Nordea in their Nordea Annual Report 2023, page 18: “We exercise our voting rights at annual general meetings (AGMs) to support initiatives related to the environment, biodiversity and human rights.” (link here)

Norges Bank Investment Management (NBIM)

During last year’s AGM season, NBIM voted in favour of the Follow This climate resolution at both Exxon and Chevron. Recently, the fund’s chief executive Nicolai Tangen came forward to criticise ExxonMobil’s ‘aggressive’ climate lawsuit against shareholders (www.ft.com).

Mark van Baal: “We hope that Norges Bank will also vote in favour of the climate resolution at Shell this year. Their vote will send a strong signal to the boardrooms of all oil majors including Exxon’s.”

Why votes matter

After 20% of shareholders voted in favour of the climate resolution in 2023, Shell recently backtracked on its 2030 climate target, and scrapped a 2035 target just before coming into view of its 10-year planning window. This demonstrates that one fifth of shareholders is not enough to drive change. Votes must increase.

The 2024 climate resolution at Shell is co-filed by 27 institutional investors with €4 trillion in assets under management.

Voting backs up engagement activities

With their definition of active ownership, these large Norwegian investors are true stewards of the global economy. Many of their European peers see engagement as the preferred tool to exert influence. But conversations behind closed doors will not prevent Big Oil from continuing to cause climate breakdown. Engagement is only effective when it is backed up by voting. Therefore, we ask investors to support the climate resolution at Shell on 21 May.

Reference

- A voting analysis report by Follow This on the voting behaviour of large institutional investors from the UK was widely covered, highlighting the role of HSBC in voting in favour of climate resolutions amid reluctance among UK peers.

- Collected quotes from Norwegian institutional investors on the topic of voting and active ownership

- The Guardian: UK investors backtrack on support for climate resolution at oil firms’ AGMs

- Bloomberg: HSBC Challenges Big Oil More Often Than Peers, Study Shows

- The Independent: UK asset managers ‘backtracked on climate resolutions at oil major AGMs’

- Responsible Investor: Big UK managers oppose all Follow This climate target proposals at oil majors

- Energy Voice: HSBC challenges Big Oil more often than peers, study shows (energyvoice.com)

- PA Media: UK asset managers ‘backtracked on climate resolutions at oil major AGMs’