PRESS RELEASE

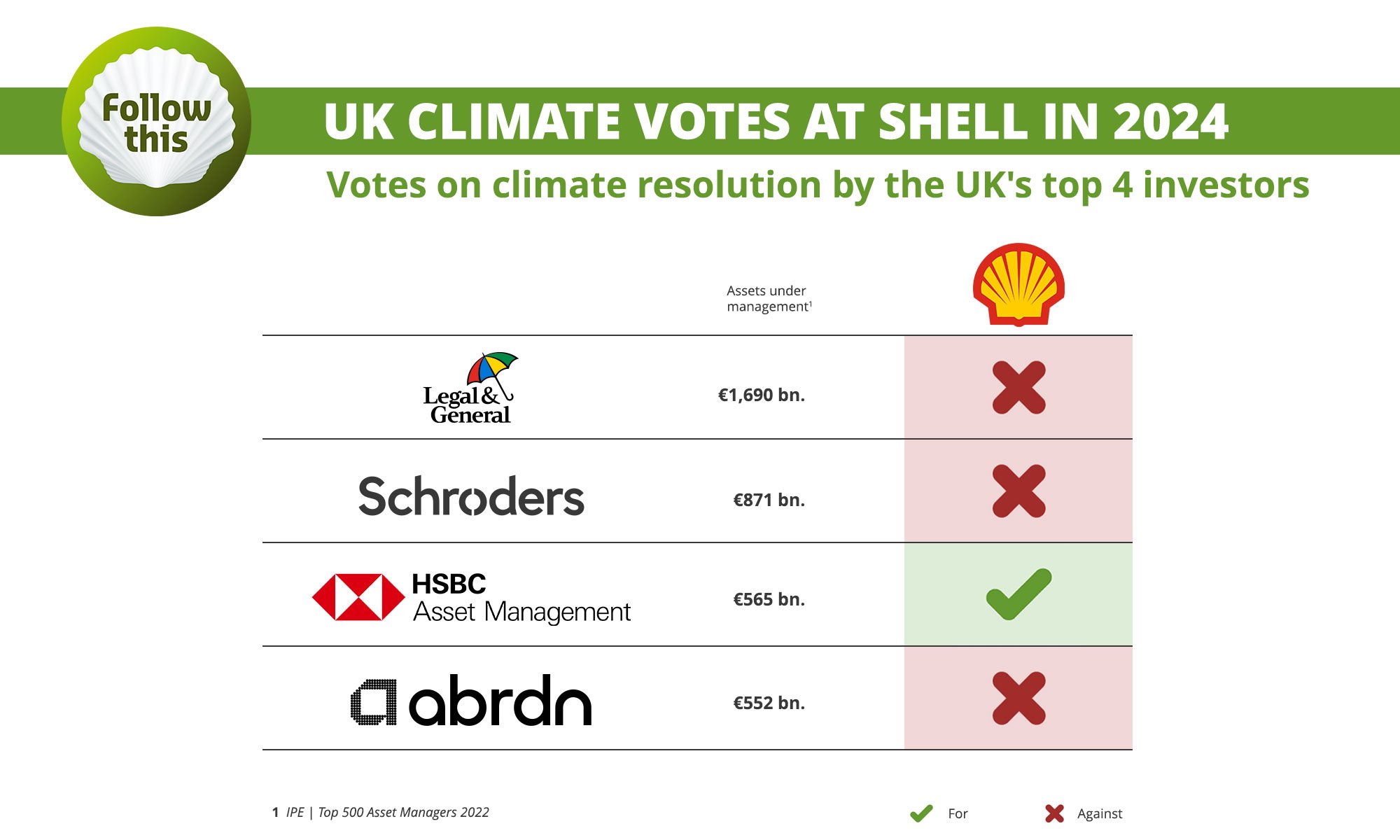

Three of the largest UK investors voted against climate resolution at Shell, accepting Shell’s strategy of not reducing emissions

Three of the four largest investors in the UK voted against the climate resolution at Shell, Follow This reveals today (sources below). With their votes the investors accept Shell’s strategy of not reducing emissions this decade. The climate resolution requested Shell to align its medium-term targets with Paris.

“By voting against Paris alignment at a major oil company, these three major investors raise doubts about their climate credibility,” says Mark van Baal, founder of Follow This. “They claim to be committed to achieving Paris but voted the opposite. Furthermore, these three investors leave their 27 co-filing peers and the CA100+ lead in the cold.”

“In their voting behaviour at Shell, HSBC is the true steward of the global economy among the four largest investors in the UK.”

Voting contradicts voting policies

In their (voting) policies all these investors state that companies should have Paris-aligned targets and that they support resolutions that ask for Paris-alignment (see below). They all know Shell moved even further away from Paris alignment.

However, these are their rationales for voting against:

- Legal and General Investment Management (LGIM) states its votes against Paris-alignment with “the proposal imposes inflexibility”. LGIM also voted against Shell’s Energy Transition Strategy, leaving the company in the dark about what the UK’s largest investor expects from Shell

- Abrdn explains it “frequently engages with Shell” (full statements and sources below)

- Schröders didn’t publish a voting rationale

Follow This: “Shell’s climate retreat demonstrated that engagement without voting is ineffective. HSBC and CA100+ lead engager MN realize that engagement and voting are not mutually exclusive but rather enforce each other.”

- HSBC voted in favour, stating, “the proposal would contribute to the better management of climate-related issues.”

Climate resolution

At Shell’s AGM, 19%, (down from 20% in 2023) has urged Shell to improve its climate targets by voting in favour of the Follow This climate resolution (item 23). Moreover, 22% voted against Shell’s watered-down strategy (item 22). These investors follow a group of 27 peers (with € 4 trillion assets under management) who co-filed the resolution. They also follow MN, the lead engager at Shell on behalf of the Climate Action 100, the world’s largest investor alliance to “ensure the world’s largest corporate greenhouse gas emitters take necessary action”. The climate resolution supports the company to align its medium-term emissions reduction targets with the Paris Climate Agreement.

Voting rationales and sources

Legal & General Investment Management

Shareholder resolution – climate change: LGIM expects companies to introduce credible energy transition plans, covering their direct and indirect emissions and consistent with the Paris objectives. A successful transition to a net zero emissions economy requires all sectors to align with those objectives and hence we place significant importance in our engagement and voting policies on Scope 3 emissions being integrated into a company’s energy transition plan and decarbonisation efforts. Although we support the principles of this proposal, a vote AGAINST is applied as in our view, the wording of the proposal imposes inflexibility on a company that is subject to the non-linear demands of the energy transition and could lead to several unintended consequences, including those related to security of supply and the implications of divestments to less responsible operators, as we transition to a net-zero emissions economy. Our approach to such resolutions will remain dynamic.

Abrdn

SV2: Abrdn frequently engages with Shell as part of a dedicated engagement programme and has established milestones for the company concerning climate. We acknowledge positive steps taken by the company, for example in relation to significant near-term investment in low carbon energy solutions. However, we note the changes to the company’s climate strategy and targets that were announced at its 2024 Annual ESG Update. Amendment of targets can erode investor confidence and we will make this a key issue for future engagement. We remain concerned that the resolution may not result in real-world emissions reduction and could have other unintended consequences. We have therefore opted to vote against the resolution but will continue our engagement with the company and could take voting action in future.

HSBC

We believe that the proposal would contribute to the better management of climate-related issues.

Climate policies and sources

All the investors in question support the Paris Agreement. They all state that companies should have Paris-aligned targets (Abrdn even requests absolute targets) and support resolutions that ask for that (LGIM and Schroders). The Follow This proposals make a very straight forward request for Paris alignment; nothing more, nothing less.

Please find the specific policies which support this below:

Abrdn:

“We expect and encourage companies to:

- Demonstrate that a robust methodology underpins Paris aligned, net zero goals and targets.

- Set targets for absolute emission reduction, not just carbon intensity, to show a clear pathway to net zero.”

LGIM:

“Engaging with the companies in which we invest – to ensure investee companies’ strategies are aligned with the net zero trajectory, to seek assurance that boards consist of individuals who can drive businesses to succeed through the energy transition, and to ensure companies are disclosing appropriate levels of risks and opportunities presented by the implications of climate change.”

“Following the adoption of the Paris Agreement, LGIM has been a consistent supporter of shareholder resolutions calling on companies to improve their climate transparency, greenhouse gas management and climate-related lobbying. To help bring more standardisation in this area, LGIM has also been publicly supportive of efforts to introduce a ‘say-on-climate’ vote, whereby companies submit their climate transition plans for periodic shareholder approval.”

Schroders:

“We will continue to support appropriate shareholder resolutions that we believe will help push companies to transition and align with our key climate expectations.”