Follow This works together with investors for climate action.

Investor briefings are an important way for Follow This to convince large institutional investors to support climate resolutions. We share information to help them understand why voting for our resolutions is crucial. We also encourage investors to announce their support publicly. This helps create media debate and peer pressure among other investors.

Engagement with progressive investors is key to how Follow This works. In this partnership, Follow This always acts as a confidential partner and honest broker of information.

By uniting with key investors to vote for climate resolutions, we support oil majors to put sustainability at the core of their strategy.

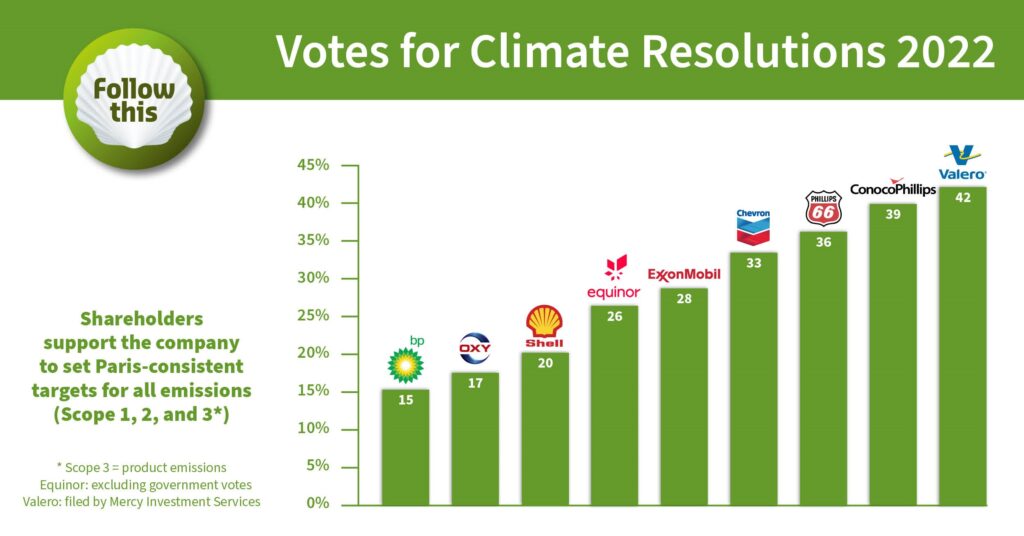

The Follow This resolution requests oil majors to set emission targets for all emissions in line with the Paris Climate Agreement.

The Follow This resolution offers shareholder backing for change. Key to the resolution is that it is encouraging and supportive. It spurs the company on to take leadership in the energy transition.

But it didn’t go all that quickly. “The first months were really difficult,” he relates. “How often have I heard people say, ‘Oh, you want to change Shell. That’s a noble cause.’ They didn’t believe that we would actually succeed.

In this video, you see a young guy dancing in a park for several minutes all by himself. After a while a couple of others join him – the first followers – and then it takes off and a whole crowd joins in. “When I decided that I wanted to change Shell my wife showed me the video clip, and said, ‘That’s what you are going to do.’ And she was right.”

Eventually, more and more people got in touch and wanted to help with the mission of Follow This. The team of volunteers supporting Follow This grew larger and larger. “I am impressed every day by the drive and the brainpower of our young team members: students and recent graduates who are looking for work with a purpose.”

Investor rationale to vote for the Follow This resolution is primarily financial. Investors foresee that they cannot make a decent return on their capital in a world economy disrupted by devastating climate change. Continuing to expand oil and gas production over the next decades will bring investors’ entire portfolio in danger. This explains why more and more institutional investors want to avoid an above -2°C world at all cost.

Aegon: “Aegon considers it very important that the goals of Paris are actually achieved in the interests both of society and of our clients for whom it is important that the investments that we make with their pension money are free of climate risks.” (press release)

Church of England: “The position we take in supporting the Follow This resolution at Shell is not one that is targeted at Shell nor is it intended to imply that we see you as a laggard on this issue. Rather, it is based on our belief that we need targets across the whole oil and gas sector and not just at Shell.” (open letter to the Chairman of the board of Shell).

We have made the choice of Shell, BP and Equinor and their investors transparent, and peer pressure followed. For example, after trailblazing shareholders (Actiam, Van Lanschot Kempen, MN, and the Church of England) publicly supported the climate resolution at Shell, others also voted for or abstained.

As a result of the transparency that we created, we have a seat at the table of institutional investors. In our engagement, we are a constructive partner and an honest broker of information about what needs to be done to achieve the goal of the Paris Climate Agreement.

We don’t communicate information gained from these confidential and no-obligation meetings. We stimulate individuals who want to make a difference and encourage investors to publicly announce their support for the resolution to stimulate debate in the media and within other investor groups.