PRESS RELEASE

IEA predicts oil and gas demand will decline after 2029, but Shell heavily invests in fossil fuels, risking stranded assets

Prior to today’s Capital Markets Day in New York, Shell declares its intention to grow its fossil fuels business* in a press release.

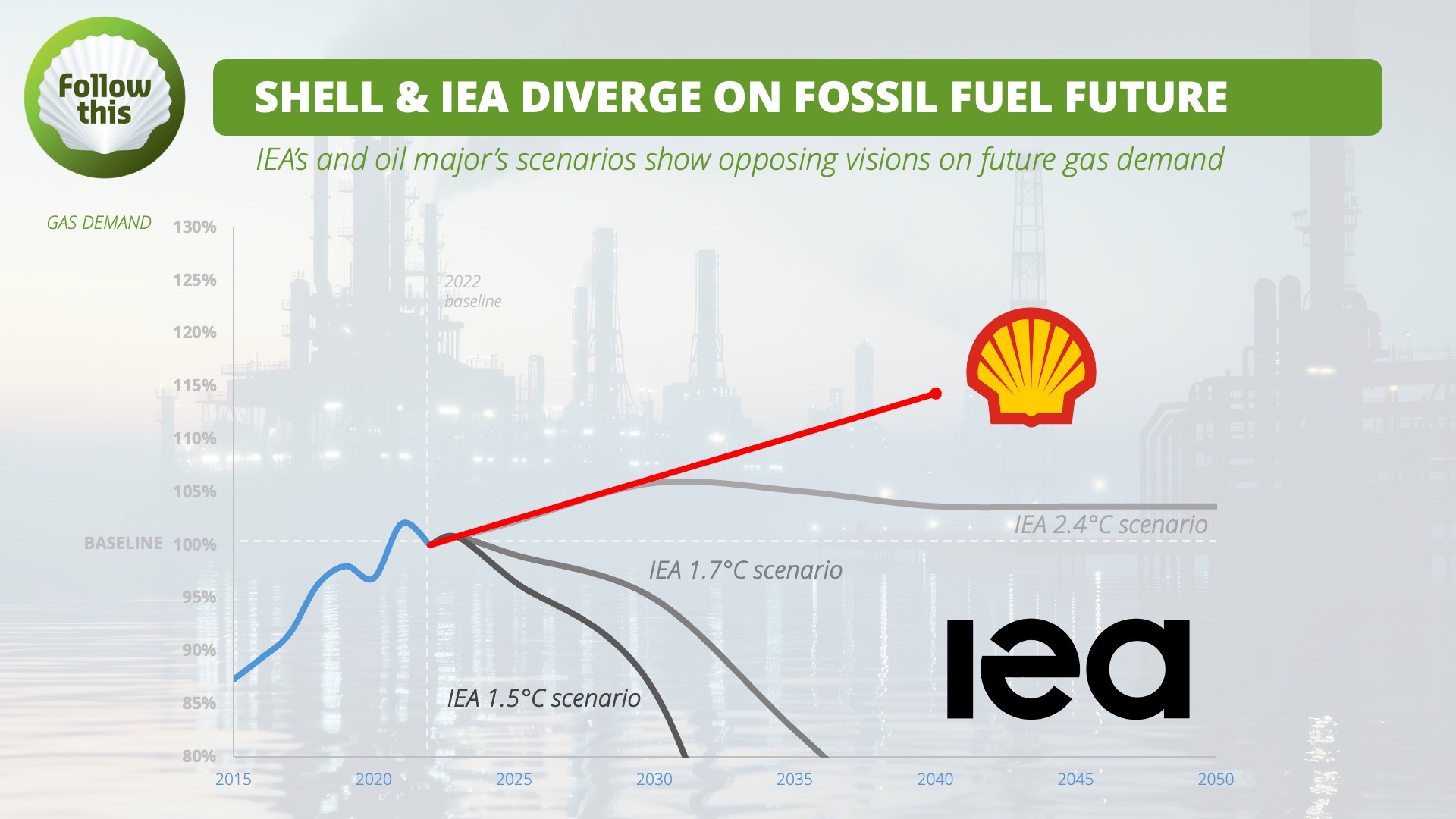

“The board is endangering Shell’s future by ignoring the global energy transition and continuing investing in potential stranded asset in oil and gas,” responds Mark van Baal from Follow This, a group of green shareholders. The International Energy Agency (IEA) forecasts a decline in oil and gas after 2029 in all scenarios (graph below).

Ignoring market trends

Van Baal points out that “shareholders should be concerned about Shell’s stubborn disregard for market trends, including the increasing demand for clean energy.”

He adds: “Shell risks a dramatic decline in share value as the market adjusts to the realities of disruptive innovation, stranded assets and climate liabilities. Sooner or later oil companies will be held liable for the costs for climate damage.”

Risk of carbon lock-in

Investing heavily in fossil fuels could delay the energy transition and increase the risk of carbon lock-in, making it more challenging for Shell to pivot to renewable energy sources. This strategy also contradicts with the Paris Climate Agreement, which calls for a 45% reduction in emissions by 2030.

Call to investors

“Investors committed to the Paris Climate Agreement have a crucial role in influencing the board of Shell, one of the world’s largest emitters, to pivot towards sustainable energy. Big Oil can make or break the Paris Accord. That’s a decision for shareholders,” Van Baal states.

Opportunity for leadership

“Shell could use its current profits, engineering prowess, and global market-making capabilities to explore new, sustainable business models instead of exploring more fossil fuels. Shell has the opportunity to lead and thrive in the energy transition instead of clinging to an outdated carbon-based model.”

Lack of vision

“Shell’s current strategy shows a lack of vision for a future beyond fossil fuels, which is a failure to recognize the inevitability of disruptive innovation,” Van Baal concludes.

Financial think tank Carbon Tracker has indicated that to address the climate crisis effectively, two-thirds of existing fossil fuel reserves must remain in the ground and will become stranded assets.

* Shell press release states: “[Shell will] grow top line production across our combined Upstream and Integrated Gas business by 1% per year to 2030, sustaining our 1.4 million barrels per day of liquids production to 2030 with increasingly lower carbon intensity.”