Board is unable to provide clarity on navigating the decline in fossil fuel demand

PRESS RELEASE | May 20 2025

During its AGM today, Shell’s board failed to address key shareholder concerns regarding the company’s response to the expected decline in oil and gas demand. Despite pressing questions from Follow This about the sustainability of dividends and the risk of stranded assets after peak oil in 2029, the board provided inadequate answers. Moreover, a shareholder resolution, requesting disclosures about Shell’s gas growth strategy got a strong vote.

Mark van Baal of Follow This commented: “Today’s AGM demonstrates that more and more shareholders do not accept that the board puts the future of the company at risk by stubbornly sticking to a century old business model that risks being disrupted within five years,” responds Mark van Baal of Follow This.

Stranded assets

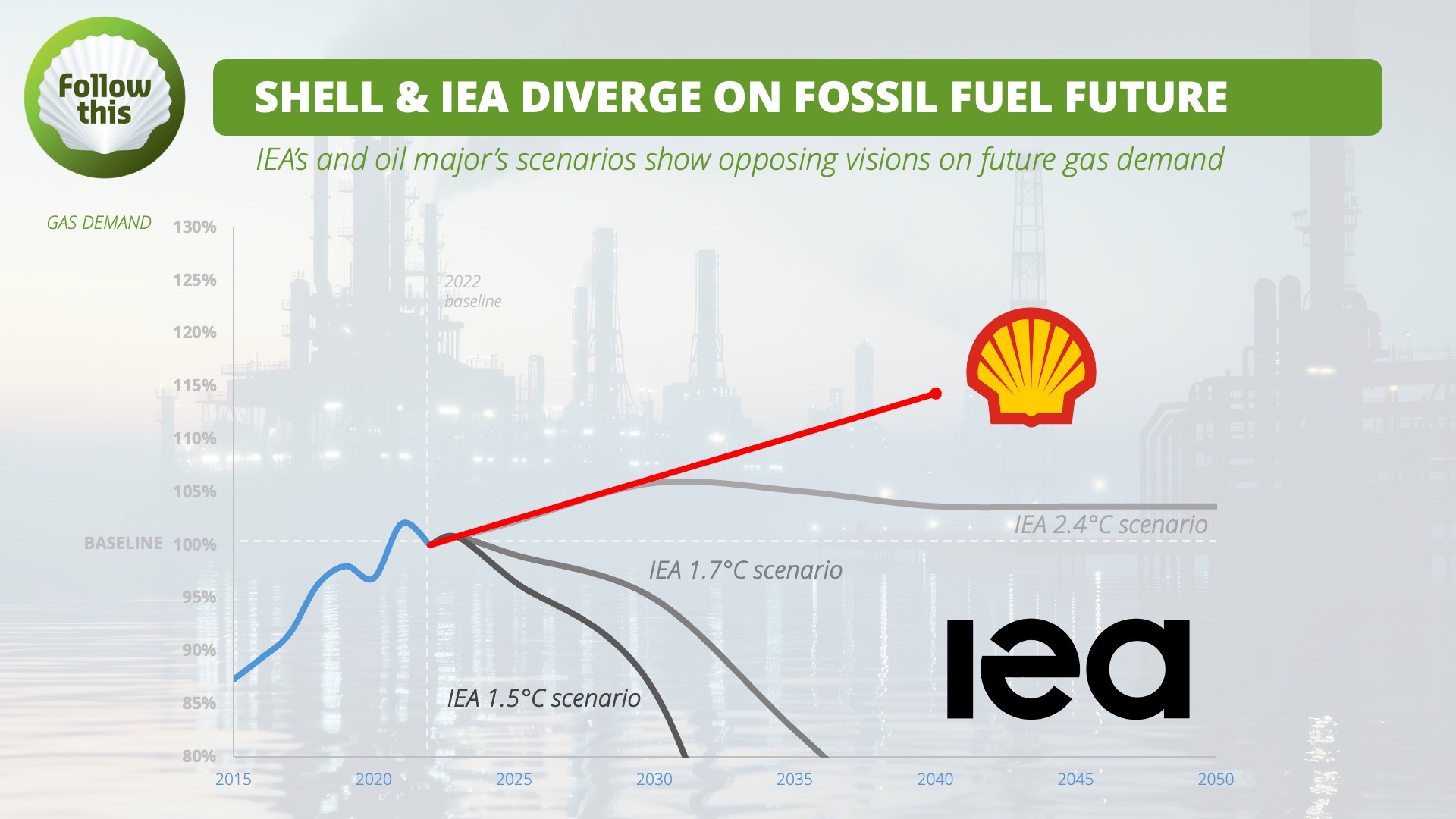

Tarek Bouhouch of Follow This reminded the board that in all IEA’s scenarios oil and gas demand will decline by 2029. He questioned the logic of pursuing new oil and gas projects in a contracting market without risking stranded assets, referring to CarbonTracker’s research. The chair dismissed the IEA scenarios as “one view of world” and pointed to Shell’s own scenarios. Bouhouch responded: ”I feel a responsibility to warn fellow shareholders: our board is putting our investments at risk by doubling down on a declining sector. Mr. Sawan and Mr. MacKenzie, are you continuing with business-as-usual because you believe the fallout will come only after your tenures end?”

Dividends

Rosa High of Follow This asked Shell CEO Wael Sawan whether the company could maintain its dividend payouts if the oil price drops below $40 per barrel – a realistic scenario after 2029 when demand for oil and gas will decrease according to the IEA. The board dismissed the IEA scenarios once again and did not answer the question.

Rosa High told journalists: “The absence of an answer demonstrates that the board cannot guarantee dividend payouts in a declining oil and gas market. This is worrisome for shareholders. The only way to mitigate this high dependency on fluctuation of oil prices is to diversify in new technologies and new business models in clean energy. We as shareholders support Shell to do so.”

ACCR resolution

A shareholder resolution, filed by ACCR and institutional investors, requesting disclosures about Shell’s LNG growth strategy, secured 21% of the votes. “The strong investor support for this resolution highlights widespread concern about Shell’s strategy, which is at odds with all International Energy Agency (IEA) scenarios,” responds Mark van Baal.

No Follow This climate resolutions amid investor hesitation

For the first time since 2016, Follow This did not file a climate resolution. It’s a strategic pause to get more investors on board and to discuss how to work together to uphold shareholder rights. Follow This, having reached a steady 1 in 5 support for its resolutions, remains committed to work with financial institutions as the best remedy for the climate crisis.

For further details, read the press release here:

Follow This pauses climate resolutions for Big Oil in 2025 amid investor hesitation