MEDIA UPDATE | November 16, 2025

Major US investors skip Brazil summit as fossil fuel lobbyists dominate climate talks, raising doubts about Wall Street’s commitment to Paris goals.

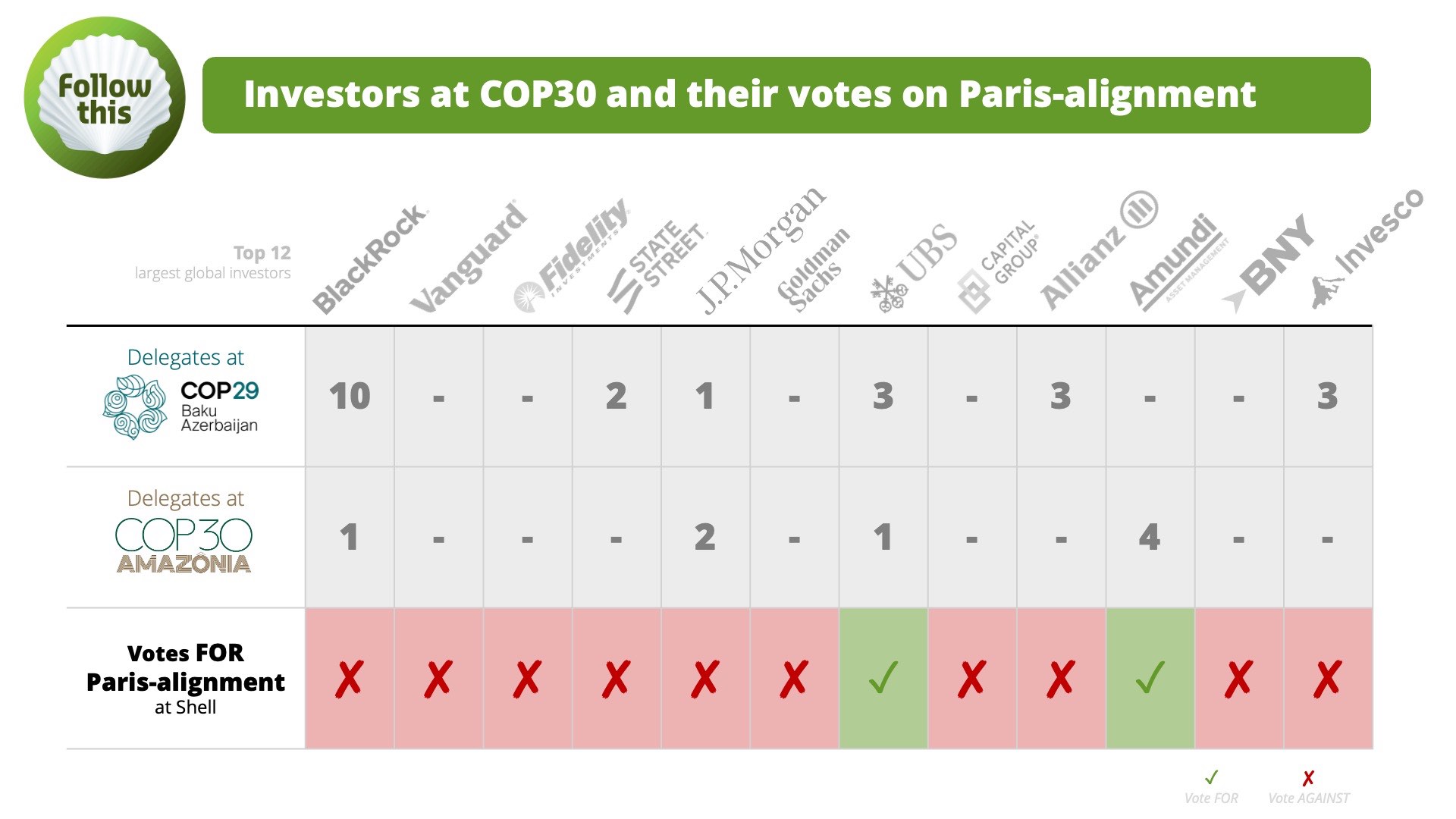

Major US asset managers, including Vanguard, State Street, and Goldman Sachs have skipped the COP30 climate talks in Belém, Brazil. BlackRock sent one delegate compared to ten last year, according to the list of participants, analysed by Follow This. In contrast, two major European investors – UBS and Amundi, maintained and increased their presence in Belém, underscoring the widening transatlantic divide on climate action (see table below).

Large US investors have a long record of voting against Paris-aligned shareholder proposals at oil and gas companies such as Shell, raising fresh questions about their climate credibility (see table).

“The largest asset managers face the biggest financial risks when the climate crisis hits the global economy,” says Mark van Baal of Follow This. “Their voting record at major emitters, combined with their absence at COP30, puts their clients’ money at risk.”

Record fossil fuel presence

Their absence comes as fossil fuel lobbyists flood COP30 with one in every 25 attendees representing oil, gas, or coal interests, according to new analysis by Global Witness. Their findings show fossil fuel lobbyists have been granted more than 1,600 access badges to COP30. The result: fossil fuel lobbyists now outnumber delegates from nearly every country, triggering renewed calls for stricter conflict-of-interest rules at the COP.

“When the largest investors stay silent, they support the status quo. That is not neutrality, that’s complicity.”

Mark van Baal – Follow This

Echoing Trump’s rhetoric

In a UN speech in September, President Trump declared: “If you don’t get away from this green scam, your country is going to fail.” The decision of the largest US asset managers to skip COP30 echoes this rhetoric and marks another step away from global climate engagement, leaving the field open to fossil fuel interests.

“US asset managers are following Trump’s lead and walk away from the table at a decisive moment,” says Van Baal. “By staying home, they hand influence to lobbyists who oppose a transition. The financial sector should take the lead.”

“When the largest investors stay silent, they support the status quo. That is not neutrality, that’s complicity.”

Voting for Paris reduces portfolio risk

“The portfolios of these global investors are most susceptible to devaluation caused by devastating climate change. It is incomprehensible that they don’t intervene in companies that contribute most to this risk, especially because they are shareholders,” says Van Baal.

“The best contribution they can make in tackling climate change is voting for change at the AGMs of the largest emitters.”

UBS and Amundi voted for change at Big Oil. However, BlackRock, State Street, and JP Morgan backed board strategies with effects far beyond the boundaries of the Paris Accord.

“Global players like BlackRock, State Street, and JP Morgan have billions to lose as a result of devastating climate change. Investors must reconsider their support for Big Oil’s investments in more fossil fuels and align their votes with their financial duties.”

“Shareholders have the authority to steer companies toward their climate obligations and away from activities that threaten long-term value.”